IMPORT CONSULTANCY

IMPORT CONSULTANCY

- Customs Advisory including all steps of Import Shipping, with the goal of attaining Customs Clearing swiftly and safely.

- Analysis of the whole operation to conform to the current norms, as well as administrative treatments, pre-boarding Import Licensing requirements;

- Tributary and financial management, including a complete analysis of all costs and expenses incurred in the operation, including estimates, expenses detailing and payments flow;

- Previous analysis of all documentation emitted by the supplier according to the Brazilian legislation;

- Complete follow-up of all shipments through contacts with overseas suppliers, cargo agents, carriers, etc.;

- Revision and readjustment of Fiscal Classifications – NCM;

- Importing License (L.I.) procurement, by consent of government organs such as: DECEX, ANVISA, Ministério da Agricultura (Agriculture Ministry), INMETRO;

- Specialized consulting for operational procedures’ readjustments to the INTERNATIONAL COMPLIANCE RULES (OEA);

INTER ADUANEIRA provides consultancy to companies that intend to qualify to the Programa Brasileiro de Operador Econômico Autorizado (Brazilian Program of Authorized Economic Operator), in partnership with consulting firms in Law and Customs Audit.

- To the certified operators in the Programa Brasileiro de Operador Econômico Autorizado will be conceded benefits related to the facilitation of customs procedures, both in the country and overseas.

- These benefits may be generic or granted according to the certification mode (SECURITY, ACORDANCE or FULL), the operator function in the logistic chain of the measured accordance grade.

Identification of the applicable fiscal benefits and project preparation for tributary reduction or tribute payment deferment, such as:

The Drawback Special Regime allows companies to import or acquire, in the domestic market, raw materials, inputs, secondary materials, parts and packaging for the manufacture of export goods. It is an export incentive, with direct effects over imports and domestic purchases, thus reducing inputs cost.

Inter Aduaneira, through its consultancy, provides solutions to the market for Drawback Processes Management.

We have a dedicated team, whose professionals are selected and internally developed with specific knowledge and skill sets in Foreign Trade, Business Administration, Tax/Fiscal Accounting and Tax Law.

Among the Management Tools in our consulting service, we highlight: (By clicking on the icons, the site will open a textbox with the following items).

AUDITS: Currently utilized audits aiming to mitigate risks in a possible inspection.

LIABILITY IDENTIFICATION: Identify and correct legal and administrative failures, aiming to minimize and eliminate its impacts.

OPORTUNITIES: Analysis of imports and exports, with the goal of identifying the best regimes for the benefit utilization.

TECHNICAL VISIT: Technical visit to understand the production process and identify possible inputs for utilization.

OPTIMIZATION: Optimization of the tributary economy levels, through involvement of the client’s Fiscal, Accounting, Tax, Logistic and Engineering Departments.

Ex-Tarifário – Tributary reduction for Machines and Equipment;

The Ex-Tarifário consists in a mechanism to reduce the Capital Goods (BK), Informatic and Telecommunication (BIT) Import Tax, when there is no national similarity.

The benefit is granted to machines and equipment, executional units and machines combinations, allowing for the reduction of the whole tributary chain, since the Import Tax is the calculation basis of all the other taxes.

The INTER ADUANEIRA Special Projects’ Team relies on qualified professionals for the viability study, the preparation of a technical document dossier and monitoring of the required analysis of the Ex-Tarifário plea until its final approval by the competent federal organs.

In the last few years, we had success in the publication of countless Ex-Tarifários related to various national and multinational industries, thus enabling the implantation of major installation or expansion projects of industrial units.

It is a Special Customs Regime that allows the importation of goods that must remain in the country for a specified duration, with a complete or partial tax break.

It allows the temporary utilization of machines and equipment supplied through rent, leasing, loan, tests, fairs and expositions, sports competitions, etc., and may be converted to definitive import.

It is allowed for the import of used machines and equipment, even with national similarity, precisely by its temporary status.

Manufacture To Order/Services Export

There is yet the regime of Temporary Importation for Active Improvement that allows entrance in the country, with a full importation tax break, during a defined period, of goods or merchandise to be submitted to a transformation, elaboration, processing or assembly operation, with a posterior reexportation of the final product.

Allows the storage or foreign goods, in a public bonded quarter, with a federal tax and the PIS/Pasep and Cofins contributions’ break incident on import.

The customs clearance may be partial or total, according to the client’s needs.

It allows for a reduction in the product stocks and the production supply optimization.

It promotes, also, the cash flow management for the product localization taxes, as the company localizes only what is of immediate use.

Allows the transportation of goods in national territory, under customs control, from one point to another of the customs territory, with a tax break.

The Customs Transit regime is a benefit conceded to Importers and Exporters in the freight of its goods between customs zones, before customs clearance

Through this Special Regime, the companies may choose the best place to process the customs clearance formalities, according to the most favorable logistic costs or even facilities’ proximity.

Special import tax regime that seeks to benefit predominantly exporting legal entities.

RECAP allows, in the case of selling or import of new machines, instruments and equipment, the exemption of the PIS and COFINS requirements incident over the gross revenue on the domestic market and the PIS Importação and Cofins-Importação.

Allows for an export without immediate physical transference of the goods overseas.

The goods are sold through a DUB (Delivered Under Custom Bond) contract, which obligates the seller to deposit the goods in a bonded storage authorized by the Secretaria da Receita Federal (Federal Revenue Secretariat), under the buyer’s orders.

Allows the import of specific equipment to be directly utilized in research and mining of petroleum and natural gas reserves, without the incidence of the federal tributes – II, IPI, PIS and COFINS, together with the freight additional to the merchant marine renewal – AFRMM.

REPETRO allows for the possibility, as the case may be, of utilizing the following customs treatments: Fictitious Export, Drawback Suspension regime import, Temporary Import regime import.

INTER ADUANEIRA also provides consultancy to companies that intend to qualify in REINTEGRA, helping in the framing and requisite formalities to obtaining the fiscal benefit.

In the REINTEGRA scope, the legal entity that effects export of manufactured goods present in specific legislation, may compute values for partial or total reimbursement of the tax residue present in your production chain.

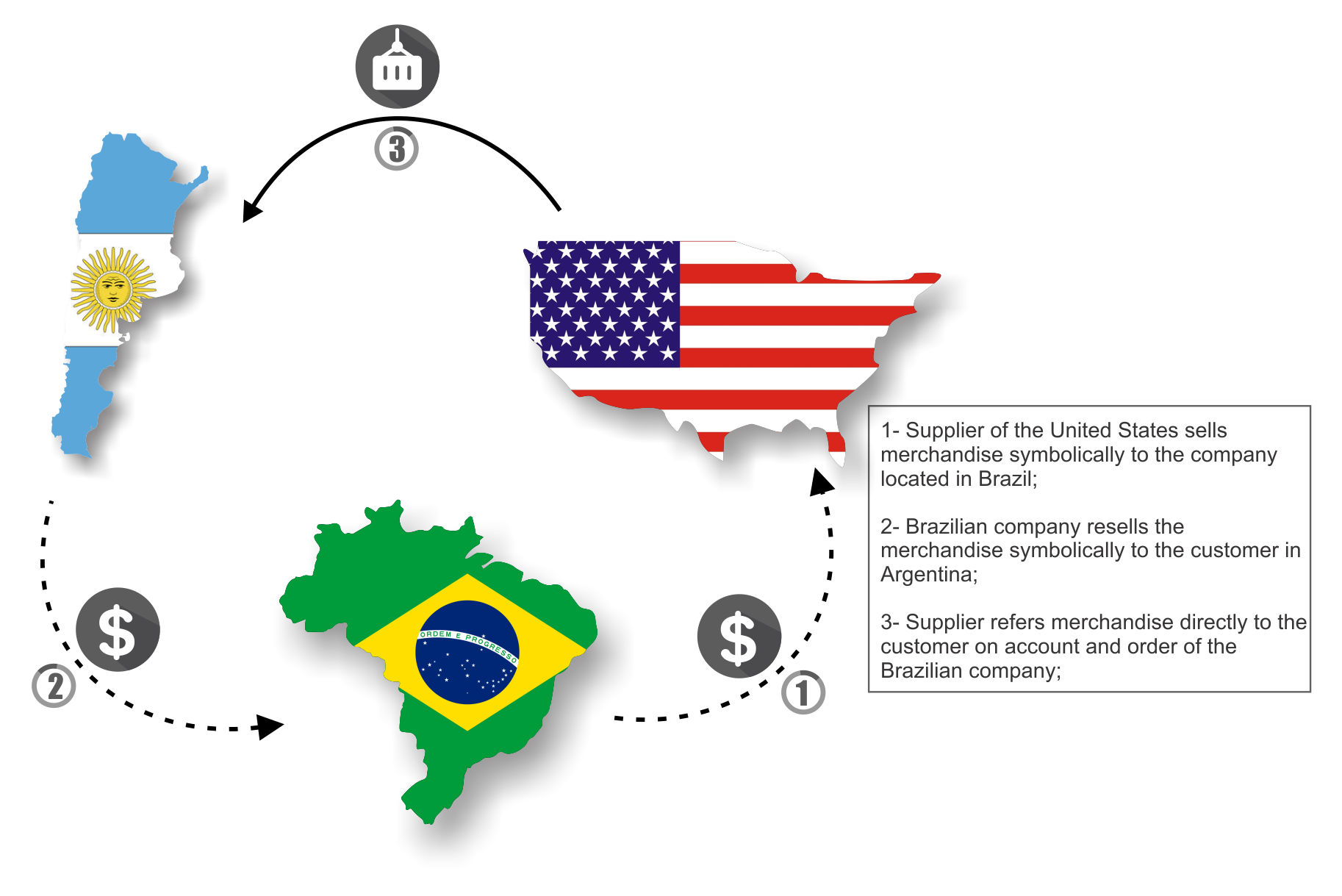

Buying or selling with participation of three distinct companies, also, can be three different countries, involved on the same operation; (link to a chart that shows this operation);

INTER ADUANEIRA also helps its clients in all procedures inherent to import of equipment and industrial lines NEW AND USED, according to current legislation and consent of the competent organs.

Imports of USED machines and equipment, specifically, are authorized, provided that these are not produced in the country, or can’t be substituted by others, currently manufactured in the national territory, for the purposes for which the imported material was intended.

To that end, the INTER ADUANEIRA Special Projects Team possesses the “know-how” for all technical and documental guidance necessary for conducting this plea.

The INTER ADUANEIRA Group’s Special Projects Team counts with qualified professionals to prepare and run projects for obtaining state tax benefits, on behalf of its import clients, such as:

ICMS Deferment – PTA (Special Regime)

Benefit granted to imports of raw materials, intermediary products and packaging materials, promoted by an industrial establishment with the expressed end of processing.

ICMS Deferment – ADI

Benefit granted to the import of goods to consolidate the permanent asset, with no similar manufactures in the State of Minas Gerais, for use in the importer’s own establishment.

ICMS exemption /ICMS Calculation Basis Reduction

Benefit applicable to imports of medic and hospital equipment, subject to a counterpart in medical services scheduled by the Minas Gerais State’s Secretaria de Estado da Saúde (State Health Secretariat) (Only on EXEMPTION cases).

A verification of inexistence of a national similar is required, both on ICMS exemption and ICMS calculation basis reduction.

ICMS Conta Gráfica – SP State

Benefit granted to imports of goods to consolidate permanent assets without national similar, promoted by companies established in the State of São Paulo.

** ICMS benefits in other states are subject to consultation and specific studies, as per current norms and legislation.Â

INTER ADUANEIRA has a team of qualified professionals for a complete consultancy on the operations liable of mandatory records on SISCOSERV, complying with specifications of Receita Federal (Federal Revenue).

- SISCOSERV is an Integrated System of Services Foreign Trade, created by the Federal Government, to record transactions encompassing services, intangibles and other operations that produce variation in assets and liabilities, specially SERVICES IMPORT AND EXPORT operations.

How we can advise your company in these regulations:

- Study of all operations related to services acquired or bought from companies or entities located overseas to determine their applicability to the Siscoserv regulations;

- NBS framing analysis and suggestion – Brazilian

Service Nomenclature;

- Identification of legal deadlines for registry;

- Registry of acquisition operations: RAS and RP;

- Registry of sale operations: RVS and RF;

- Legal Consultancy in the case of challenges and defense against Notice of Infraction or required Preventive Measures.

CONTACT US